Technology has revolutionized how we can use money. Customers can buy products without even setting foot in a physical store. Families can send money to each other, even if they’re located in different parts of the world. Investors can even buy or sell a stock with the click of a button. Finance and technology go hand-in-hand in this day and age, which has led to the birth of a new industry: Fintech.

What is Fintech?

According to Investopedia, Fintech, a combination of the words “financial technology”, is a term used to describe technologies that provide or improve financial services.

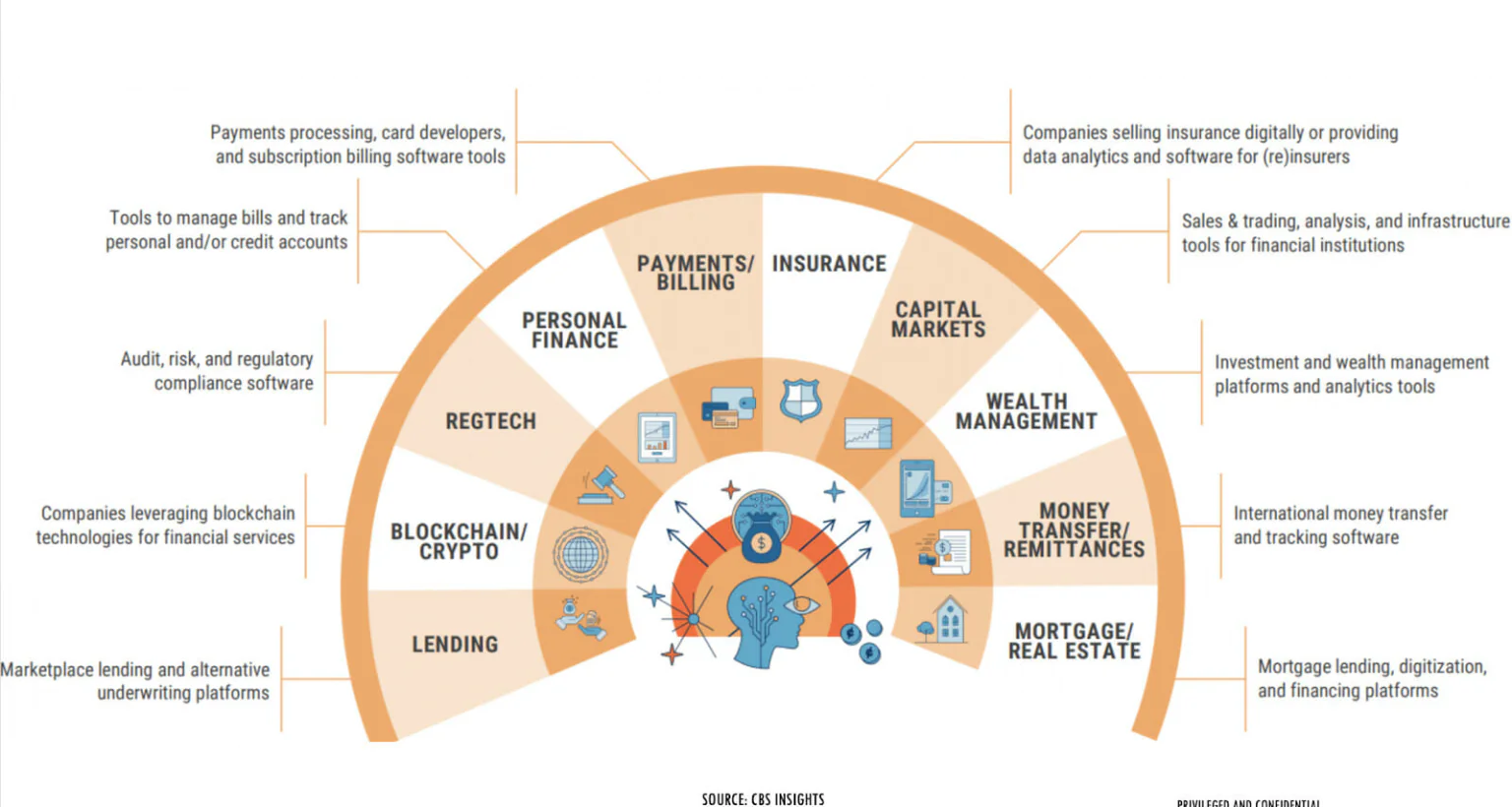

Fintech is a broad industry. As there are different uses for money, such as saving, spending, and investing, there are also different Fintech products and services. These are provided by various Fintech companies.

What Are Fintech Companies and What Do They Do?

Fintech companies are businesses that provide technological financial solutions to customers. These enterprises vary in size, from small startups to established financial institutions, and provide various Fintech services. These services include, but are not limited to:

Lending

Fintech companies have given everyone from everyday consumers to growing businesses a new way to borrow money. These lending services have allowed people to apply for loans without a bank, which is especially useful to customers with an immediate need.

Equity Financing

This is the process of raising capital through the sale of shares and other forms of compensation. Fintech companies have given small businesses and startups a new avenue to gain the funds they need to operate and grow.

Digital Wallets

Cash is no longer the only way to spend money. Digital wallets are a convenient way of storing and transacting with money. Besides being a secure place to store funds, many of these wallets have built-in features such as investments and bill payments. Some of these wallets are even integrated directly into online stores and banks.

Personal Finance Management

With various Fintech solutions such as budgeting apps and software, personal finance management has never been easier. Businesses develop these apps for individual consumers to manage their funds and financial well-being.

5 Challenges in Fintech Product Management / Development

While the Fintech industry is broad and full of different branches, many companies face similar challenges when it comes to providing the best product to their customers. These are five of the most common challenges faced in Fintech Product Management:

1. Compliance with Regulations

The biggest challenge that Fintech organizations face is compliance with numerous regulations. These regulations can heavily restrict Fintech companies from growing. This is especially true for organizations that are providing services in numerous countries as laws and regulations vary among different jurisdictions. Some examples of these regulations include Anti-Money Laundering (AML), Know Your Customer (KYC), and Know Your Business (KYB).

2. Integrating Big Data and Artificial Intelligence

Big Data combined with AI can help product teams in a number of ways. When used together, they can perform risk analysis, monitor customer trends, and automate various processes.

However, Fintech organizations are hesitant to adopt them as these require expertise and constant maintenance to use effectively. Teaching AI must be done through machine learning which requires proper training to utilize and understand.

3. Adopting Blockchain Technology

A new technology that has gained much popularity within the Fintech space is Blockchain technology. One of the main advantages of Blockchain technology is tracking all phases of a transaction without risk of failure. This can be useful for a number of Fintech branches, such as lending, digital wallets, and personal finance management.

Blockchain is still fairly new as technology and organizations have merely scratched the surface for its uses. It is also costly to maintain which may dissuade smaller companies from incorporating it into their product.

4. Improving User Experience and User Retention

Today, customers do not want products that simply work and do as advertised. To retain customers, the Fintech organization must provide them products of exceptional quality. Providing a top-notch product and experience to your customers will aid in retention.

5. Providing Personalized, Valuable Experiences

Customers want products that are not only high quality, but cater to their specific needs. Companies can only learn what these needs are if the customers are involved in the development cycle of the project.

How Fintech Product Managers Can Address These Challenges

These challenges are real threats to your Fintech company’s growth, but they can still be navigated through. Here’s what Product Managers can do to address these problems:

Deliver Fast. Deliver Often.

Speed of delivery is particularly important in the Fintech Product Management space. Customers use various Fintech software products such as digital wallets and financial tracking apps on a daily basis. Due to how frequently customers use these services and the growing number of competitors within the space, any bugs or issues will quickly become apparent.

This may cause customers who rely heavily on your service to utilize a similar, seemingly more reliable service. Thus, negative feedback from customers must be addressed as soon as possible.

All of this means that adopting an Agile approach – and specific Agile methods such as Scrum and Kanban – is highly recommended. By using an Agile or a Hybrid-Agile approach, Fintech organizations can launch new products and versions early and often, get market feedback and enhance the product based on these short feedback cycles.

Speeding up your delivery does not necessarily mean working faster. It can also mean focusing on delivering features that stakeholders most want to see implemented in your product. This means limiting the number of features to be released during each cycle to just the ones that stakeholders want to see the most rather than as many as possible. By doing this, you would be releasing the most desired features in the fastest possible time.

Speed of delivery is only one aspect. The cadence at which you release new features is just as important. The moment you deliver a feature, customers will have more demands to be met. Thus you must establish feedback loops to continually understand what your stakeholders want.

This means your delivery cycles must not only be fast, but frequent as well. This will generate short feedback loops ensuring frequent customer feedback and continually improving products.

Build Cross-Functional Self-Organizing Teams and a Collaborative Culture

Being a relatively new industry, Fintech companies operate in a volatile and unpredictable market. One of the ways a company can address market volatility is to collaborate closely with their customers using cross-functional, self-organized teams.

Given the technological complexity and uncertainty in which Fintech teams typically operate, it is crucial for them to work in a collaborative and transparent culture with their customers. In this culture, both parties work together to anticipate the market, technology, and product challenges and solve them together to get the highest value product to market in the shortest possible time.

Agile methods emphasize the formation and use of cross-functional self-organizing teams. Agile teams are more efficient at facing execution problems as they don’t have to deal with dependencies that traditional teams might have to before taking action. Thus, self-organized teams can also help increase the speed of delivery, which as we’ve established is vital to an organization’s growth.

Utilize a compliance framework

Fintech organizations have to manage a wealth of customers’ information, such as credit card information, personal information, and more. Numerous regulations are in place to ensure that all of this information is protected and isn’t used for criminal purposes.

A compliance framework is a methodology that a company can follow to help navigate through different regulations governing all of these collections of

information. Through the use of a framework, organizations can clearly visualize any processes that are being done which are not compliant with certain regulations and adjust accordingly.

A framework can help an organization pass any internal and/or external audits and in doing so helps prove to investors that the company isn’t at risk with any regulatory bodies and is potentially worth investing in. Thus, the use of a compliance framework can help a Fintech company grow and operate without being stunted by such regulations.

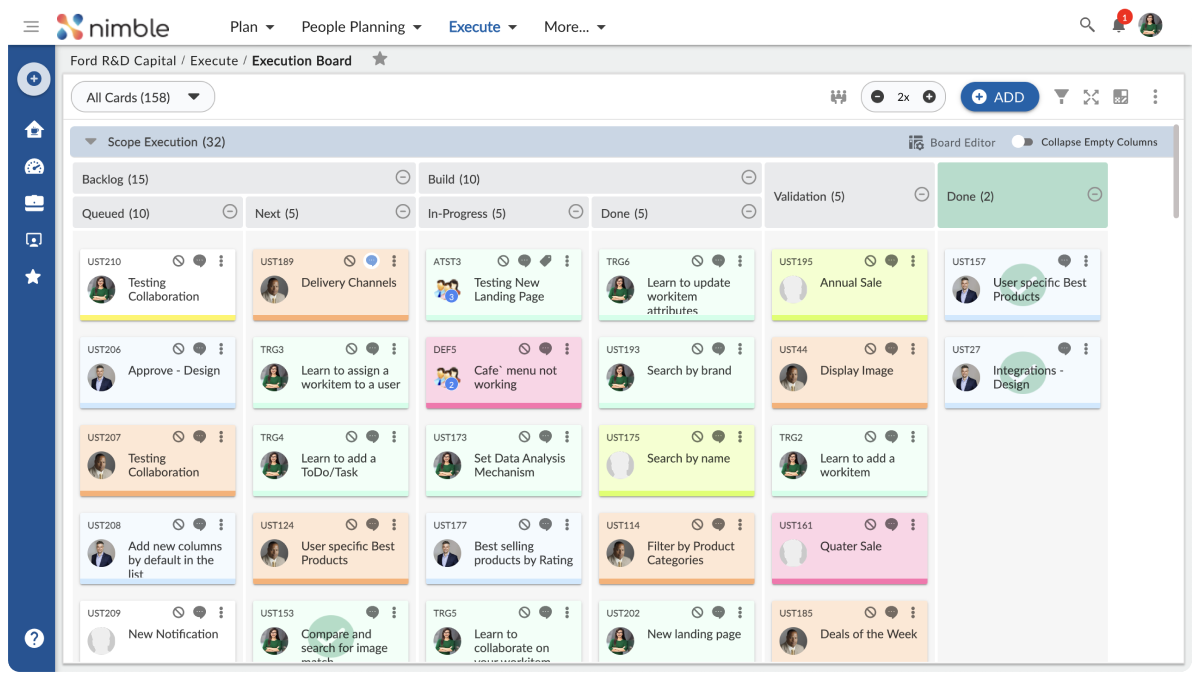

Use the right Product Development/ Management Platform

Fintech companies face all of these problems and more. However, with the right solutions, these challenges can be negligible. A product such as Nimble supports built-in Agile and Hybrid-Agile capabilities and collaboration.

It also boasts a highly customizable compliance framework to help organizations navigate through the different regulations across multiple countries as well as track metrics related to Service Level Agreement (SLA). Additionally, features such as SwiftRules and SwiftReports help monitor and control compliance with your current processes.

If you are interested in a work management tool that can help your Fintech organization grow, you may request a demo here.